FTC Chair Lina Khan's Fight For American Genomics Industry Against Incestuous Illumina Part 1

Just how China compromised is Illumina actually?

Full disclosure: Over the next week I’ll be releasing some research that I’ve done with my team on Illumina and the Grail merger. I don’t own any Illumina stock but I did do the security review for its former CEO Jay Flatley back when he was being concerned to be the head of the Office of Science and Technology Policy. Several of my companies use Illumina’s technology.

“Illumina’s acquisition of Grail would save lives, and it’s crazy for the FTC to call it a monopoly,” writes John Tamny in the Wall Street Journal editorial page.

Big if true. But is it?

Indeed this is a very similar argument to one made by Joe Lonsdale, he of Ubiome fraud fame.

We have a hard time talking about the national security implications of the monopolization of the economy. It’s far easier to compromise a monopolist than a competitive industry.

Here’s the way it works.

A nation determines it has priorities. In China’s case it has decided that that’ll be genetics. That’s why they back Beijing Genomics Institute.

The nation sends its spies out to cause trouble. You dirty up a CEO with drugs, or with sex, or by knowing his secrets. Maybe you know he has an affair with a subordinate.

You use this information for leverage. Whether you charm him or blackmail him it doesn’t matter so long as he does what you want and what you want him to do is acquire companies that you control. Once the companies merge you get your spies in the company and you can begin the raiding of the companies’ IP.

I’ve spoken repeatedly and emphatically with the FBI’s counterintelligence about the national security problems at Illumina and recently Tech Crunch pointed out what was going on where patient data was being exfiltrated.

This revelation is a smoking gun that said data exfiltration must have been going on for a long time.

Why was the CTO announcement made over LinkedIn and not a letterhead communication directly to all instrument owners?

To what extent is Illumina’s chairman John W. Thompson’s personal ties to China attributable for this lapse in security? Shouldn’t Thompson, who after all worked for security firm Symantec, have been all over this? (Unless, of course, he supported or ignored) the raiding of the data due to his own very personal ties with the Chinese.)

Indeed the evidence seems to be that Thompson is pushing this GRAIL deal through.

Where is Francis DeSouza’s focus? On his employees, evidently, and one employee in particular — a rather young, rather pretty administrative assistant who has since left the company.

To make matters weirder still the assistant was the daughter of former (and perhaps future) CEO, Jay Flatley’s administrative assistant.

We live in a country where the CEO of Burger King was fired for having a consensual affair with a subordinate.

There are credible reports that this affair (conducted before DeSouza finalised his divorce) became public knowledge at Illumina. If this is so, it would be a good question to ask if the board were aware of this, and what actions they took, if any. This is clearly something that demands serious investigation.

It is clear, however, that this Illumina board, chaired by Thompson, is in no position to conduct this investigation given Thompson’s extensive personal and proffesional connections to DeSouza, as well as his history of poor handling of inappropriate behavior by board members.

For example, in 2019 it was discovered that Bill Gates had engaged in an affair with a subordinate in 2002. In response, John W. Thompson appears to have engaged in an attempt to hide the presence of an inquiry into Gates’s behavior from members of the board not directly aware of the inquiry, an action which was noted as being very unusual for this kind of incident.

The Grail Purchase

Executive Summary

Ilumina (ILMN) created a division, GRAIL, to produce an early‐stage cancer detection test. In 2016, GRAIL was spun‐out and raised outside capital from billionaires and institutions at a valuation of $1‐2 billion

In May 2018, Grail raised a $300 million C funding round which included the following Chinese connected companies: Ally Bridge Group, Hillhouse Capital Group, 6 Dimensions Capital, Blue Pool Capital, China Merchant Securities International, CRF Investment, HuangPu River Capital, ICBC International, Sequoia Capital China, and WuXi NextCODE

All of the companies involved in this C funding round, are either 1) state owned funds, 2) connected to the various Wu Xi companies founded by Dr. Ge Li, 3) prolific investors in the Chinese security state, or 4) deep supporters of the Chinese Communist Party (CCP)

In September 2020, a mere two years later, the DeSouza led board announced the intention to purchase Grail for $8 billion dollars. An increase of 5.3 times the investment made by the series A, B, C and D investors despite GRAIL not having received FDA approval, rising public doubt of GRAIL’s potential, and GRAIL’s increasing operating losses

ILMN’s announcement to buy GRAIL was questionable at best, but CEO deSouza’s much more egregious and inexplicable decision was to have ILMN actually close the GRAIL deal despite being informed by the EU that ILMN was not permitted to close the deal. The EU also stated that, if ILMN closed the deal over the EU’s objection, ILMN would be subject up to $450 million of fines, GRAIL must be run without any input whatsoever from ILMN, but ILMN would still be forced to fund GRAIL’s operating losses, including ~$800 million in 2023 alone

Since closing the GRAIL acquisition, ILMN’s stock has dropped 62% or $50 billion in value. ILMN has already taken a $4 billion impairment charge, warned of significant tax liabilities upon exiting GRAIL and accrued ~$450 million in fines. ILMN will tell you they will expeditiously divest GRAIL. But the sad truth is, due to their obsession with GRAIL, they will continue appealing against the EU, and more recently, the FTC decision to block the deal. These appeals will go on for years at shareholders’ expense and will, at the very least, absorb the capital needed to defend against ILMN’s rising competition. At worst, these actions by CEO Francis deSouza and the board will become an existential question for ILMN

Given the devastating negatives associated with this GRAIL purchase the extensive connections between the ILMN Board in the shape of chairman John W. Thompson, CEO Francis DeSouza and the Chinese state/ Chinese Communist Party (CCP) deserves significant attention.

Chairman John W. Thompson in particular has a long and storied connection to the CCP through his roles at Huawei-Symantec, Microsoft, Light Speed Venture Partners, as well his failed attempt at becoming the US Commerce Secretary under Bar Obama in 2008-2009

CEO Francis DeSouza has extensive personal and professional links to chairman Thompson and despite protestations from the ILMN board, it would seem clear that his arrival at ILMN, and promotion to chairman, involved the input of Francis DeSouza

DeSouza has a history of incredibly dishonest and ethically questionable behaviour which includes significant breaches of fiduciary duty in the case of this divorce from Erica DeSouza, as well as engaging in a deeply inappropriate (and publicly known) sexual relationship with a subordinate at ILMN

Given 1) the close connections between Thompson and the CCP, 2) DeSouza’s ethically questionable behaviour, 3) Thompson’s and DeSouza’s personal closeness, 4) the timing of the GRAIL C funding round, and 5) the subsequent determination by the DeSouza board to purchase GRAIL at a grossly inflated price against all reason; it is obvious that the GRAIL purchase hints towards something very untoward having happened. Not only did this purchase cause grievous harm to ILMN, a US company, but it also enriched various companies that have deep and significant ties to the Chinese security state, a state which has publicly made it clear that genomics is a matter of national security focus

John W. Thompson’s Chinese connections

Huawei Symantec

John W. Thompson is an individual who has extensive and troubling connections to the very highest rungs of the Chinese state. Connections which have in the past led to serious national security misgivings.

Whilst it is not clear exactly when Thompson’s very close relationship began with the Chinese Communist Party (CCP), it is apparent this relationship was shockingly close during his time at Symantec which began in 1999, a mere year before Huawei began to enter the security technology field. This is an interesting coincidence as Thompson is known for pivoting Symantec towards a security systems focus during this time.

In May 2007 Huawei Technologies Co. Ltd, a company now consider an arm of the CCP, and Symantec Corporation (now Gen Digital Inc.) entered into an agreement to create a joint venture to be named Huawei Symantec, an entity which was established in February 2008.

This joint venture, in which Symantec owned 49%, was terminated with the purchase of Symantec’s share by Huawei in March 2012.

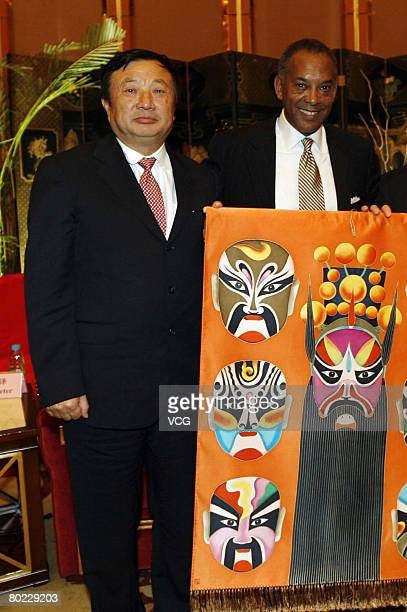

John Thompson, CEO of Security software maker Symantec and Ren Zhengfei President of Huawai Technology Co, attend the unveiling ceremony of the Huawei Symantec Technologies Co., Ltd. on March 12, 2008 in Chengdu, Sichuan province.

The official reason provided by the Symantec board for the termination of this joint venture was a general parting of business plans, with differing investment priorities, but the real reason appears to have been that there were serious national security concerns over Huawei, concerns which have only become more concrete since this time.

In November 2022, the FCC banned the sale of Huawei equipment in the US on national security grounds.

Given that not only did John W. Thompson head a company that brought Huawei into the security technology field in the US, but co-headed a joint venture with Ren Zhengfei who is strongly suspected, if not now assumed to be, a Chinese Communist Party agent by western security services, it raises some serious question about Thompson’s judgement at the very least.

Not only was the venture not profitable, but it turned out to be a serious national security risk.

Incredibly, this is not Thompson only connection with investments and businesses deeply connected to the CCP.

We will explore more in subsequent posts.