End of the Chinese-Backed Tech Cults: Toward Dirigiste, Not Egoist

Is venture capital returning to its roots? It must.

My work at Thoughts and Adventures will always be free but if you like it, please do share it with a friend. Or even an enemy. Who knows who reads this stuff?

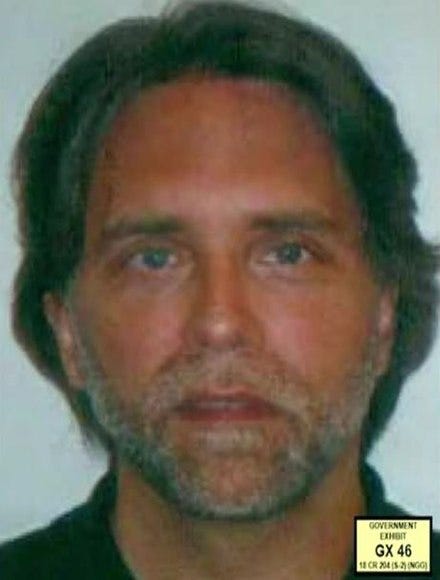

Many years ago I spoke on the phone with Keith Raniere, the now jailed cult leader behind NXIVM. I would have been about 21 or 22 years young and boy was I naive. I believed as all nerds secretly do — that the world is an IQ test and that all one has to do is find your people in whatever cloistered ivory tower or think tank or start up you might join. As I said, I was naive.

Anyway I had been introduced to Raniere by a criminal with strong ties to various intelligence agencies and not a few billionaires and by Sarah Bronfman, the scion later jailed for her participation in the human trafficking cult.

Being somewhat weird myself I asked Raniere if the reports about him having a 180 IQ were true. He blathered on and I knew right then and there that I was dealing a fraud. I informed the criminal who had introduced us that, no, I wasn’t terribly interested in working together. He smacked of being a cult leader.

Far from being perturbed, my criminal friend said only, “Of course. That’s how it is. Everyone with any power is a cult leader.”

Later that criminal went to Burning Man with Elon Musk. He palled around with Eric He already knew Peter Thiel.

Cults are all around us and especially in Silicon Valley. In recent times the most obvious cult was Theranos or WeWork, both of which have strong connections to the intelligence communities of America and Israel.

We know this because they were obvious. Elizabeth Holmes wasn’t even particularly original with her mimicry of Steve Jobs and Adam Neumann may have just done too fast what Israeli-American billioniare Ike Perlmutter did in stealing building Marvel.

Cults, we know, exploit innate vices and compulsions, which, in turn, feed back into Reid Hoffman’s view of investing in the Seven Deadly Sins. Most recently Hoffman gave a commencement address at Vanderbilt stressing the importance of friends and networking.

Left unsaid is how sometimes you can have the wrong sorts of friends. Like, say, Jeffrey Epstein, who was an investor in LinkedIn and helpful to Hoffman, a Microsoft board member. The real relationship with Hoffman-Epstein has never been satisfactorily probed.

No, what we really need aren’t people loyal to one another — no mafiaosos, please — but patriots. We may well ask if we have people within the government smart enough to do the kind of public-private partnerships essential for our future.

Franco-American Georges Doriot, to whom we shall turn later and who moved in both government and entrepreneurial circles, was successful, but being the future now, do we have the kind of talent that Silicon Valley would recruit working within our own government? Do we have the kind of Silicon Valley entrepreneurs who would want to work with the government at all?

From the French, we got the word entrepreneur. Perhaps now we should appropriate dirigiste.

I’ve been asked a lot what I think of the choppy market we are in. Is this the end of the bull run which began in 2008 when the Chinese bailed out the boomer property market and left their already impoverished children with the bag?

For what it’s worth I date the rise of the bull market to the advent of the iPhone, which is itself made in China but designed in California by the cult leader known as Steve Jobs — peak boomer if ever there were one.

Like the dictatorship of North Korea which still pays fealty to the long ago deceased dear leaders, you can see vestiges of that exploitative boomer attitude in the “return to work — or else!” attitude now engulfing Apple.

This is the mindset of the cult leader who wants you to participate in his temple rituals — not the team leader who thinks of the care and well being of his team.

Well then, what do I make of it all? Is this the end of Silicon Valley?

To that I say: Well I certainly hope so! Let’s end all these cults. Cheap money leads to a lot of cheap morals and poor decisions.

Another way to think about it is that the Chinese are exiting our system. AUKUS is strengthening itself and rolling back Chimerica (and Chisrael)’s excesses.

You get a sense of that in the frightened comments of Ambassador Qin Gang who called upon Asian-Americans to help Sino-American relations which seem to be at a nadir ever since the Chinese sickened us all and then lied about it.

The Koreans elected a pro-American leader who is clear-eyed about the threat posed by the North and its enabler, China. The Japanese are waking from their slumber though they may be too old to matter much. The Australians are bragging about how they’re turning dissenting Chinese spies against the CCP while a Chinese spy ship operates in their territorial waters.

In Britain the very pro-China Dominic Cummings is out, obsessed as he was by the crazy lockdown politics. They’ll be no Singapore on the Thames. Good riddance to bad rubbish! Chinese-compromised Marshall Wace, helpful as it was on Brexit, is on the back foot. Huawei has no foothold. The British-American-Australian alliance has never been stronger. Nick Clegg stands ready to take over Facebook now that our Mossad connected friend Sheryl and dilettante Mark are . Soros’s foundation is managed by a Brit. So, too, I hear, is Bill Gates’s. (If true, are we using Gates’s existing pro-China investments and contributions for AUKUS purposes yet? I wonder.)

And America? We have work to do.

To defeat the Chinese we will become, I fear, a lot like them.

This, alas, saddens me greatly. I long for the America of the West, of the frontier, of adventure and derring do and can do where Man versus Nature can really make something of himself. This was, after all, the America I was promised and which runs in my blood since my ancestors came ashore. I am a son of the American Revolution on both sides.

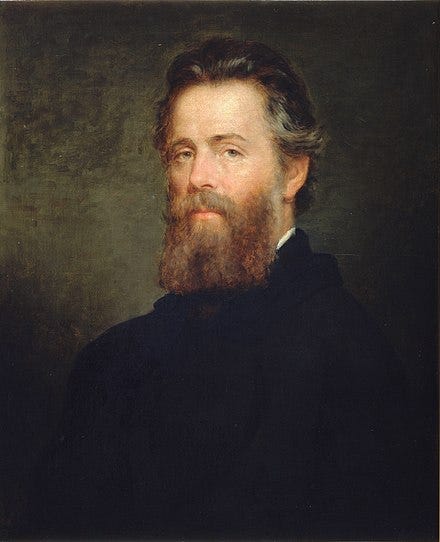

But I’m stuck with the simulacrum. I got married in Alaska — that last frontier turned resource colony — and I have invested in space, the final frontier. I find myself drawn as Herman Melville’s Ishmael was: “As for me, I am tormented with an everlasting itch for things remote. I love to sail forbidden seas, and land on barbarous coasts.”

Interestingly Melville’s heir — great-great-grandson of Herman Melville Allan Chapin — does tech investing with yours truly. He likes a good adventure. It’s in the blood.

But we don’t really do that sort of thing anymore, do we? No. We are apologetic for whaling, for colonization, for settlement, for reading dead white men, and most of all, for adventure. Born too late to voyage the earth and too early to explore the cosmos. The middle children of history. I got into venture capital because I thought I might go on an adventure. Indeed this damn blog is written with just that in mind. It’s called “thoughts and adventures,” after all. I believe that a life lived well is a life of thought and action.

But much of venture capital has become, instead, a form of reverse Chinese colonization: the United States runs up a debt, the Chinese get our dollars and then deploy the dollars in our tech ecosystem. They weaken us with our vices and we let them. We have long discussed the way in which Big Tech has become the sin industry once more ever since Reid Hoffman palled around with Jeffrey Epstein. As with all drug dealers it’s hard to see Tik Tok as anything other than kicking out the middle man. Tik Tok should obviously be banned along with Snapchat and Facebook.

Through the Chinese alliance with the Sinaloa cartel they push opioids on our redneck population — the same population which fights our misbegotten wars. Our China-compromised Big Pharma injects healthy and ill alike with experimental drugs. We are addicted to both spiritual and literal opium. The mobbed up like it that way.

To be sure, in the past, and in some cases Chimerica — oddly close to chimerical, as in “hoped for but illusory or impossible to achieve” — works well when it is focused on the objectives of both powers. Both China and America got rockets, satellites, genetics and cheaper electric cars out of the marriage of convenience. Nobody look too close at the Uighurs slaves making your consumer products, OK? Apple phones may be made in China but designed in California.

You can think of the Obama regime as pushing the snooze button. He gave the Chinese-compromised Elon Musk money from NASA and Department of Energy and now Musk is being unspooled. The nerd in me asks the obvious: Isn’t he supposed to get us to Mars? Why then is he messing around with buying Twitter? We all know the deal won’t happen. We wanted flying rockets and we got 280 characters (as if that were an improvement). Between the SEC, the IRS, and a whole host of other government agencies breathing down his neck and closing in, it seems likely Musk will collapse under the weight of all the scrutiny. Nearly every man in his family loses their mind in their fifties and Musk has just entered his fifties. Genealogy is destiny.

Collapse seems imminent, too, for Andreessen Horowitz, itself the ne plus ultra of the Chinese-Israeli alliance. (Ben Horowitz is the son of David Horowitz, who palled around with the Black Panthers before he found it inconvenient. One wonders about what he was really doing there and how he has so suddenly become a conversation.) It’s time to build, Andreessen bleats while funding Clubhouse or the latest whatever crypto fad. Please.

Marc Andreessen himself scoops up the latest real estate. Here’s how the local real state press writes up his quarter of a billion dollar real estate purchases:

Silicon Valley venture capitalist Marc Andreessen has picked up a third beachfront home in Malibu, this one a bit downscale at $34 million.

Six months after paying a record $177 million for a surfside compound on Escondido Beach and a month after shelling out $44.5 million for a home nearby, the billionaire has plucked a two-bedroom, three-bath home from the sands near Paradise Cove in an off-market deal, Dirt.com reported.

Perhaps he’s simply following his father in law’s advice.

You can almost hear him chuckle to himself, “Software is eating the world and yet I’m investing a quarter of a billion of my money in Malibu beach front property.”

Sequoia, managed as it is by the Afrikaner married to the Chinese, is terribly boring in that whatever it invests in can be seen to continue the Chinese tactics of addicting us all. Founders Fund descends into irrelevance or somnolence as its Gen Xer partners court the obviously corrupt Mayor Francis Suarez of Miami, himself the scion of the corrupt erstwhile mayor. They hope it is DeSantis who is the next president. He won’t be. More recently Peter Thiel spoke in front of the Ayn Rand Society at Palmer Luckey’s house. Goodness. Don’t make it so obvious, Peter.

You shouldn’t say things like this and have your partners pal around with corrupt pols. Or worse yet, hire them.

"The dream of the nineties is alive in Portland,” but the hopes of the future are found in go-go Miami where you have mattress companies promising to be tech companies and Keith Rabois, always ethically challenged, is buying up Shopify businesses. After wrecked the suburbs with his OpenDoor scam, he’s on to the next parasitism. It’s all very mob but you aren’t allowed to say that too loudly. At least not yet.

Venture capital was supposed to look to the stars but the tech community can only look to its own reflection. Or follow the pack.

Tom Perkins helped give us Genentech, which changed the game for the diabetics but Perkins is long dead and so, too — if we are honest — is his firm, Kleiner Perkins. (The tell was partner John Doerr and his wife Ann’s decision to donate $1.1 billion to Stanford for a sustainability institute. Shouldn’t he just invest it instead? That is, after all, what Lord Browne is doing. He warned the world about climate change and now he’s working toward doing something about it.)

A friend says that Silicon Valley has been one of the greatest creations of wealth since the Medicis. Yeah, and what do we have to show for it? Where is our Renaissance?

Both the mob and the intelligence community rely on spotters. So, too, does the venture capital industry but I repeat myself.

If there’s anything I’ve learned in the last few years it’s that there is no such thing as venture capital. No, not really. There is no technology without a deep state pushing it forward or allowing it to exist. In fact the consumer internet itself I have more or less come to see as a Chinese op, designed to weaken and immiserate us.

So let me lay my cards out on the table, face showing.

I no longer believe that the China-backed digital drug pushers can be encouraged to invest in American national interest. They can only be compelled. Some of the Silicon Valley oligarchs will get the message and become helpful. Others will not and be destroyed. But this is how it must be. The state will not and cannot tolerate alternatives to its rule.

There is, however, another way: Recruitment of the billionaire class in the service of the nation.

There are two books that are revelatory here: VC: An American History and The Power Law: Venture Capital and the Making of the New Future. I might also include Endless Frontier: Vannevar Bush, Engineer of the American Centur. (2018) (I do wonder, though, if the military-industrial-academic pipeline that Bush imagined is simply unworkable today given the concessions that our universities have made to hostile actors and how blissfully unaware most Americans even are of the threats they face from espionage. Should Bush get the blame for this? Eh, hard to say, but he’s certainly not without criticism. The fall of Harvard and MIT in the 70s through the 2000s marks a rather sad chapter on our so-called elite schools.)

The meritocracy, in other words, doesn’t take noblesse oblige seriously because it can’t really see it. Worse yet, it ridicules that public spiritedness of the WASPs who built this country as a kind of “privilege.” Perhaps. But whose privilege? I submit to you that many immigrants are privileged to have come over to America and to enjoy all its offerings. Indeed VC: An American History (2019) by Harvard Business School professor Tom Nicholas raises notes the same families which had once invested in steel or whaling were once again behind the rise of venture capital.

The need for military innovation during World War II, followed by the GI bill, spurred America’s scientific and technological development. (This is arguably what President Joe Biden is trying to do once more with the Endless Frontiers Act and what will likely happen through the backdoor with the Ukraine military aid bill.)

A key player here was Frenchman (and Brigadier General) Georges Doriot, who lead the American Research and Development Corporation (ARD). The New England Council created the American Research and Development Corporation (ARD) to seek capital from the large asset owners: investment trusts and insurance companies. The returns for the first ten years were meager but ultimately ARD invested $70,000 ($600,000 today) to back Digital Equipment Company (DEC) in 1957. By 1972 that investment was worth $400 million and DEC was Massachusetts’ largest employer.

ARD backed 120 companies, most of which had proprietary, innovative technologies in areas including isotope conversion, water desalination, electronics, data processing, scientific instrumentation, and electrical generation. Rather humorously among the companies Doriot’s ARD-backed was none other than Zapata Off-Shore, a company headed by (future CIA director and US President) George H. W. Bush which had a novel mobile oil-drilling rig.

In other words, this was Deep State Capital.

Deep State Capital knew its place and why it was needed.

If our current tech community continues to naval gaze it will be left behind to spend its twilight years wandering around Miami. These ageing GenXers pushed the SPAC craze onto us with attendant lack of attention to detail. There was all this press to go public, go public, go public. Can you name a single SPAC that is trading above where it listed at? I tried and can’t. Maybe it would have been wiser to build out the business models and not have all these zombie companies wandering around.

One could argue, of course, that this shortsightedness is because the SEC forces quarterly reports (10-Qs) on public companies, which almost definitionally makes it impossible to look into the future. The push for profits at all costs gave us the Boeing debacle.

We should be turning toward smaller start ups and doing what we can to make sure the largest companies aren’t penetrated and can take the long view.

Vannevar Bush’s Raytheon — where several family members of mine have worked for the past three generations — was a lot cooler when it was a lot less public. I don’t think it’s a coincidence that General Atomics, say, was started by two WASPs out of central casting CIA and that it today has a spiritual inheritor, the Turkish drone company deployed in Ukraine, that is also a family-owned defense company.

Still, we need the tech community to be made American and to think of the problems America (and her allies) face. We need our greatest minds working on and anticipating the problems our world faces.

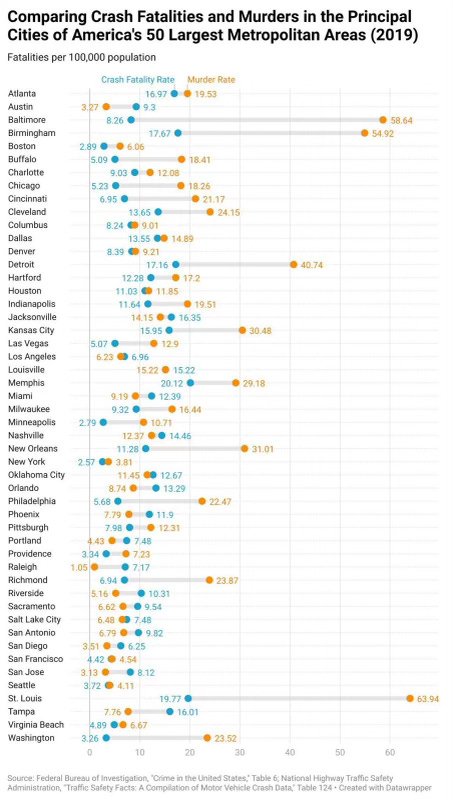

The world is urbanizing and our cities remain chaotic, violent, sometimes by design, always by neglect. Small wonder then that the bans against facial recognition, promulgated in haste, are being quietly rescinded.

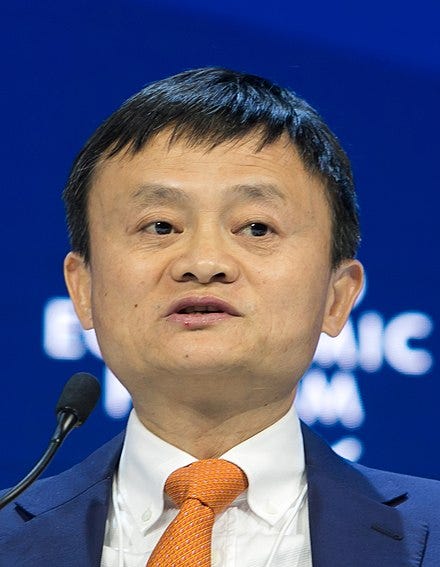

One of the conclusions I have reached over the years is that every billionaire and every cult leader (Am I repeating myself?) is a creation of a state or mob. The role we are afraid to mention is what the billionaires owe the rest of us. In the modern period, most of the billionaires got rich through their ties to the Chinese.

This is particularly galling given the moment we find ourselves in.

Rather than rising to the threat and facing it sangfroid, we harm ourselves.

We hope that by eliminating the meritocracy we might not become subsumed by the people who seem to have perfected it — the Han Chinese.

We hope by eliminating all means of ability or birth or “privilege” we might hide. But, as I said, both mobs and intelligence agencies rely on spotters. We build our own tools independent of whatever is fashionable.

We always become what we are not, raising the question of what we ever were.

One of the things that our adversaries do well is heighten the contradictions.

You say you like “free speech,” well, we will give you free speech! Yes, ultimate freedom of speech through Russian-backed Parler or Chinese-backed Twitter (to the really Chinese-backed Gettr or the whatever backed Truth Social).

You love your Second Amendment. Well, how far can we push it? Can we arm everyone right before the civil war (or national divorce)?

You love your diversity? Well, I’m going to increase your diversity by flooding your country with refugees from the Third World.

Disharmony is easy to induce if you turn satirizing the nation’s core principles.

There’s something very Darwinistic and mechanistic about how the Chinese pick winners and dismiss losers.

To lose the Mandate of Heaven (or the favor of your board) is a kind of death, especially when you buy into the cult of the founder. If you tell young, broken and egotistical young men that they are great and amazing and “founders” they’ll believe you.

The Chinese are playing upon our own romantic notions of what an entrepreneur is and engendering all this key man risk. Musk jokes about Russia assassinating him but no sane country would put itself in a position of relying on the heart beat of a 50 year old drug user to get into space.

I oftentimes feel as if we may be playing three dimensional chess whilst they are all playing Go. Right around the same time that the Chinese-backed OpenAI “beat” Go, the game no longer mattered. LinkedIn cofounder Reid Hoffman secured the Microsoft bucks for Open AI after helping Jeffrey Epstein insider trade. One wonders why Microsoft really bought LinkedIn.

Of course the real Go players play it in international affairs. You can never teach a machine to play Diplomacy, after all, and besides, who would want to play with one? The fun is playing against other humans. (Now a machine which can help you beat Diplomacy in the same way that poker or chess was beaten, well, that’s mighty interesting but only so long as you don’t share it with the class.)

So yes, we need dirigiste, not egoist, policies.

Ask not what you can do for your Silicon Valley startup but what your Silicon Valley startup is doing to us.

Imagine what all that brain power could do if it actually loved this country.

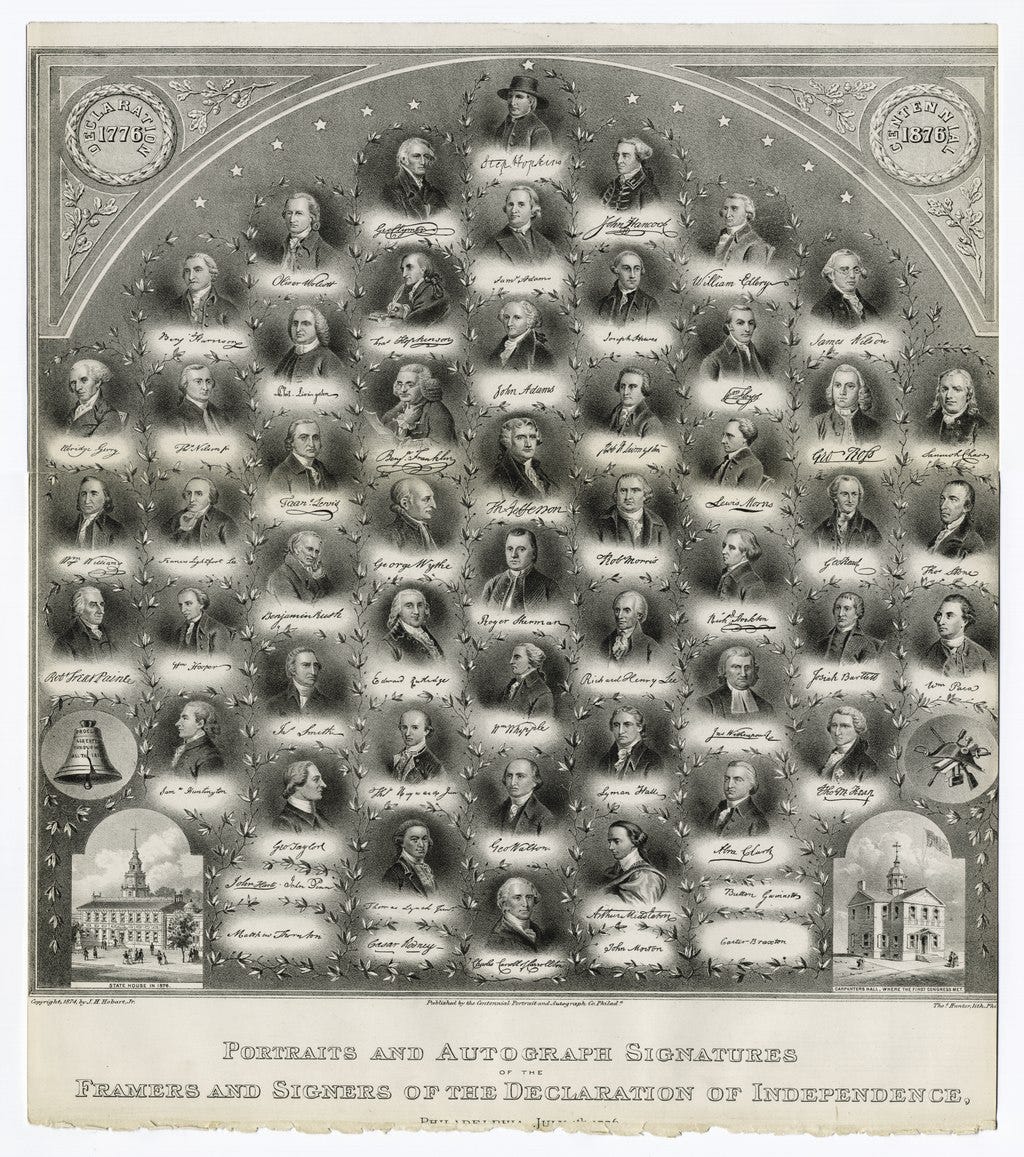

What if Silicon Valley operated like a club rather than a cult? It might take inspiration from the real Founders.

Besides, is a term sheet where you don’t pledge to one another your lives, your fortunes, and your sacred honor really a term sheet?

Great piece. Also reminded me how I loved to play the old game Diplomacy as a teen.